Proportionate Liability Reform in New Zealand: History, Debate, and Implications for Building Professionals

Introduction

On 18 August 2025, Hon Chris Penk, Minister for Building and Construction, announced historic reforms to New Zealand Building Regulation .1

The Minister explained:

- “Currently, building owners can claim full compensation from any responsible party- and it’s often councils, with the deepest pockets and no option to walk away, that end up paying out.”

- “Under this new model, each party will only be responsible for the share of work they carried out.”

- “It’s time to put the responsibility where it belongs.”

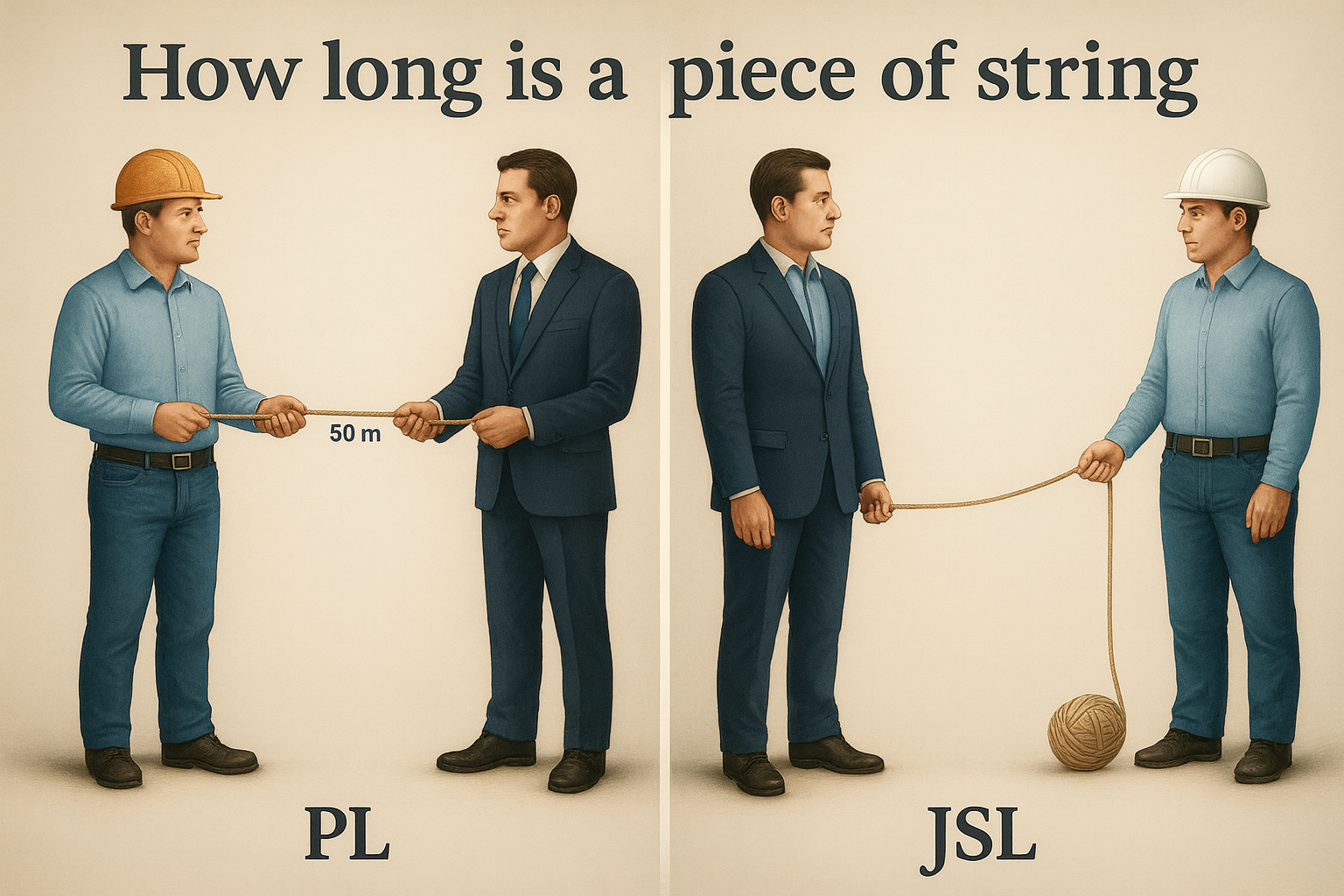

These statements go to the heart of the reform: New Zealand will move from joint and several liability (JSL) to a proportionate liability (PL) model, a change that will fundamentally alter the allocation of liability in construction disputes.

My Engagement with Liability Reform

My involvement in liability reform spans more than three decades.

- In the early 1990s, I was project director of the National Model Building Act, which provided a blueprint for building law reform in many Australian Jurisdictions.

- I was a key advisor to the Victorian Building Act 1993 in my role as instruction officer to Parliamentary Counsel and as Assistant Director Victorian Building Control. That Act remains one of the most influential building statutes in Australasia. It also introduced proportionate liability.

- Through my firm in Australia, Lovegrove & Cotton Construction and Planning Lawyers, I have advised extensively on liability disputes and the interplay with insurance for decades.

- More recently, I was engaged by MBIE in New Zealand to advise on proportionate liability and the design of its insurance framework.

This trajectory gives me a perspective that is both historical and contemporary, grounded in legislative design, case law, and practical reform implementation.

The Origins of Proportionate Liability

Proportionate liability was first introduced in the building industry in the early 1990s. It arose from concerns that JSL exposed insured professionals and councils to disproportionate liability whenever other defendants were insolvent or absent. There was massive national support for the introduction of the new doctrine.

Shortly after the turn of the millennium, the collapse of a major insurer amplified these concerns. The policy response was to expand PL far beyond building disputes. Australian jurisdictions progressively embedded PL into their Civil Liability Acts, making it the governing framework for economic loss and property damage claims across the economy.

Thus, what began as a reform confined to building law evolved into a whole-of-economy liability regime.

International Perspectives

Australia’s move has been mirrored elsewhere.

- In the United States, some states have hybrid regimes. The concept is sometimes referred to as ‘fair share liability’.

- In Canada, several provinces have introduced capped joint liability or modified PL systems, in an effort to balance fairness to defendants with the realignment of responsibility-based liability.

- The international trend is clear: an increasing number of jurisdictions are inclined to the view that liability should track responsibility, not simply deep pockets.

The Deep Pocket Problem

The inequity of JSL is well known to local government and the building practitioner community, along with the underwriters of same.

- A defendant who may be only 5% responsible for a loss can be required to pay 100% of the damages if other wrongdoers are insolvent.

- The parties left carrying the burden are usually those who are insured: councils, fire engineers, architects, and surveyors.

- Insurers end up underwriting not just their insured’s liability but also the risks of others, while ratepayers and citizens absorb the costs through higher rates and premiums.

On its surface, JSL appears to protect consumer plaintiffs. But in reality, it forces a narrow class of insured defendants and, ultimately, the public to subsidise recoveries.

The Debate: JSL vs PL

The debate between JSL and PL has been long-standing and often polarising.

The case for JSL is that it favours plaintiffs. This category of consumer is more likely to recover the full measure of their loss because they can pursue whichever defendant is solvent. From the standpoint of a plaintiff, JSL can appear a safeguard. The caveat is clear negligence has to be attached to a solvent defendant such as local government and this is not always a given.

This is why, historically, law reform commissions in both Australia and New Zealand often leaned toward retaining JSL. Their focus was primarily on protecting consumer plaintiffs from the risk of unrecoverable loss.

Yet when it came to legislating, governments in the last three decades have taken a broader perspective. Across Australia, both Coalition and Labor governments enacted PL. Their reasoning was not to weaken consumer protection but to address the hidden systemic costs of JSL.

The reality is that JSL creates two classes of consumer: The direct plaintiff — the homeowner or building owner. The indirect consumer — the ratepayer and citizen, be they Australians or New Zealanders, who ultimately bear the costs of JSL through higher insurance premiums, increased construction expenses, and greater exposure of councils.

In this light, governments’ preference for PL can be described as ultimately utilitarian. The policy choice reflected a judgment that fairness and sustainability for the many outweighed the narrower benefits for the few. By reallocating liability to reflect actual responsibility, PL better serves society as a whole, or in a majoritarian sense.

It is true that under PL a plaintiff may face recovery difficulties if a defendant is insolvent. But in recent times, it has become evident that governments no longer consider the solution to this problem is to distort liability through JSL.

The optimum solution is to adopt compulsory insurance for key actors. That is precisely what Victoria did in 1993, requiring architects, engineers, surveyors, and builders to hold insurance cover. The result has been a balanced, sustainable model: proportionate liability complemented by mandatory insurance.

Case Study: The Lacrosse Tower Fire (Melbourne, 2014)

The Lacrosse apartment fire in Melbourne provides a case study of proportionate liability in action.

In 2014, fire spread rapidly up the façade of the Lacrosse tower after flames that emanated from a cigarette ignited combustible aluminium composite panels. The litigation involved multiple defendants: the builder, the architects, the fire engineer, and the building surveyor.

The final apportionment of liability, confirmed by the Victorian Court of Appeal in 2021,2 was

- Fire engineer – 42%

- Building surveyor – 30%

- Architect – 25%

- Occupant – 3%

All the professional defendants were insured because this is a mandatory legal requirement for practitioner registration under the Victorian Building Act 1993

Although the builder was contractually liable to the owners, relief was successfully sought from the joined building practitioners and each insured professional bore their own share of responsibility.

- The Lacrosse case illustrates three points:

- Liability was allocated fairly and logically among all parties.

- No professional was forced to assume the liabilities of others.

- Insurance ensured that despite multiple defendants, the owners achieved recovery.

Why PL Plus Compulsory Insurance is Best Practice

The real policy choice is not simply between JSL and PL. It is between:

- JSL, which transfers hidden costs to insured professionals, insurers, and ultimately the public; and

- PL, complemented by compulsory insurance, which aligns liability with responsibility while ensuring consumer protection.

Victoria’s system demonstrates the superiority of the latter model. Since 1993, architects, engineers, surveyors, and builders have been required to hold insurance. Consumers are protected, but professionals are not unfairly burdened with others’ liabilities.

In New Zealand, adopting PL together with compulsory insurance would deliver the same balance. In today’s climate of high inflation and cost-of-living pressures, this balance is vital. It prevents the wider public from becoming the backstop for private liabilities.

How Proportionate Liability Benefits Fire Engineers and Design Professionals

For Fire Engineers & Design Professionals

- Fairness in liability: The impacted fire engineer is only responsible for their share of fault — no more carrying the can for insolvent parties.

- Professional dignity: Expertise is judged on its own merits, not distorted by others’ failures.

- Certainty in risk exposure: Liability can be quantified and managed with more confidence.

- Insurance alignment: Professional indemnity policies cover actual risk, not hidden systemic costs.

How Proportionate Liability Benefits Insurers

For Insurers

Predictability of exposure: Liability is ring-fenced, reducing the scale of payouts driven by the “deep pocket” rule.

- Market stability: Risk can be priced accurately, keeping premiums sustainable.

- Confidence in underwriting: Fire engineers and other professionals are no longer underwriting the failures of unrelated parties.

How Proportionate Liability Benefits the Sector as a Whole

For the Sector as a Whole

Improved collaboration: Professionals can engage without fear of disproportionate liability.

- Sustainability: A fairer, more resilient liability framework where risks can be more accurately assessed and factored in.

- Antipodean alignment: Brings NZ into step with Australia — strengthening insurer confidence and sector profitability.

Conclusion

- New Zealand is poised to join the ranks of reforming jurisdictions that have chosen to adopt a utilitarian approach to liability apportionment.

- An approach where the broader class of citizen is no longer compelled to underwrite the acts, errors and omissions of those that are perfect strangers to them.

- As Minister Penk stated: “Under this new model, each party will only be responsible for the share of work they carried out.”

- For fire engineers, architects, surveyors, and councils, this reform will improve clarity, sustainability, and fairness.

- For the public, it means liability will finally rest where it should: with those responsible.

- This is not just law reform. It is systemic reform — and it is historic.

Author Biography and References

- Adjunct Professor Kim Lovegrove DLitt, MSE, RML is a construction law reform expert and a New Zealand barrister with more than three decades of experience in building regulation and liability reform.

- He was project director of the National Model Building Act, instructed on the drafting of the Victorian Building Act 1993, and has advised governments, regulators, and industry in Australia, New Zealand, and internationally.

- Professor Lovegrove is Chair of the International Building Quality Centre (IBQC) and the founder of Lovegrove & Cotton Construction and Planning Lawyers Australia, a boutique practice focusing on construction law, regulatory frameworks, and dispute resolution.

- He has also been senior law reform consultant advisor with the World Bank in China, India, Malaysia and Malawi, advising on international best practice approaches to building regulation.

Disclaimer

This article is for general informational purposes only and does not constitute legal advice. For advice specific to Owners Corporations, building defects, or dispute resolution, please contact Lovegrove & Cotton at enquiries@lclawyers.com.au or call (03) 9600 4077.

Image Acknowledgements:

The digital renders used in this article were developed collaboratively by Lovegrove & Cotton and ChatGPT. The photo images that are not the digital renders are stock images sourced from Shutterstock.

References:

[1] Hon Chris Penk. (18 August 2025). ‘Biggest building consent system reform in decades’. Beehive NZ.

[2] Owners Corporation No 1 of PS613436T v LU Simon Builders Pty Ltd [2019] VCAT 286, [7]; Tanah Merah Vic Pty Ltd v Owners’ Corporation No 1 of PS613436T [No 2] [2021] VSCA 122.