Unequal Responsibilities

For many years, New Zealand’s local councils have shouldered an unfair share of liability for building defect claims. This burden is disproportionate because councils are neither the builders nor the designers, they often found liable for issues they did not create.

The Approval Paradox

While councils are ultimately the approval agencies, they cannot be present 24/7 at building sites. The expectations placed upon them are enormous and unrealistic.

Equitable Principles Misapplied

In principle, the party responsible for a defect should bear the liability. However, this is not the case due to the doctrine of joint and several liability, which might be unfamiliar to the general public.

Understanding Liability Apportionment Doctrines

Joint and Several Liability: The Overweight Doctrine

Joint and several liability means that in a legal proceeding with multiple co-defendants, the financially solvent defendants will assume the liabilities of any insolvent defendants. This places an undue burden on councils, who are seen as “deep pockets.”

Proportionate Liability: The Responsibility-Weighted Doctrine

Proportionate liability ensures that each defendant is only responsible for their assessed portion of the liability. In this system, liabilities do not migrate; they stay within their judicially assessed silos.

The Doctrine Dichotomy

Joint and Several Liability Explained

“Joint and several liability is a doctrine that provides that when there are a number of co-defendants in a legal proceeding, those defendants that are still standing or financially sound at the end of the proceedings will assume the adjudicated liabilities of any insolvent defendants in the same proceedings. This means that the solvent defendants assume the financial liability for other parties that through their own negligence occasioned economic harm. An astute plaintiff will do his or her level best to find a way to implicate a council in full knowledge of the fact that in a country like NZ where insurance is optional unless you can embroil a deep pocket in the legal action, a litigated victory can be pyrrhic because there will be no money at the end of the day.”

How to Fix the New Zealand Building Act 2014 – Adjunct Professor Kim Lovegrove

Proportionate Liability Explained

“This doctrine ensures that no defendant is liable for any more than his judicially assessed proportion of liability. Case in point would be a multi-party proceeding where there is a designer, a builder, and a council. When the judgment is handed down the decision maker will divvy up liability on the basis of the given defendants’ contribution to the problem. Regardless of the pecuniosity of the co-defendants, no defendant assumes the liabilities of another defendant, or to put it another way, the liabilities can’t migrate, they stay within their judicially assessed silos.”

How to Fix the New Zealand Building Act 2014 – Adjunct Professor Kim Lovegrove

The Case for Proportionate Liability in New Zealand

Without Mandatory Insurance

If proportionate liability were introduced without mandatory insurance for key building practitioners:

- Local government would benefit by not having to assume the liabilities of those primarily responsible for construction issues.

- Consumers might be left without recourse, as many building practitioners in New Zealand are not required to have insurance.

With Mandatory Insurance

If proportionate liability were coupled with compulsory insurance for key actors:

- Local governments, rate-paying consumers, and plaintiff consumers would generally be better off due to the assurance of solvent defendants.

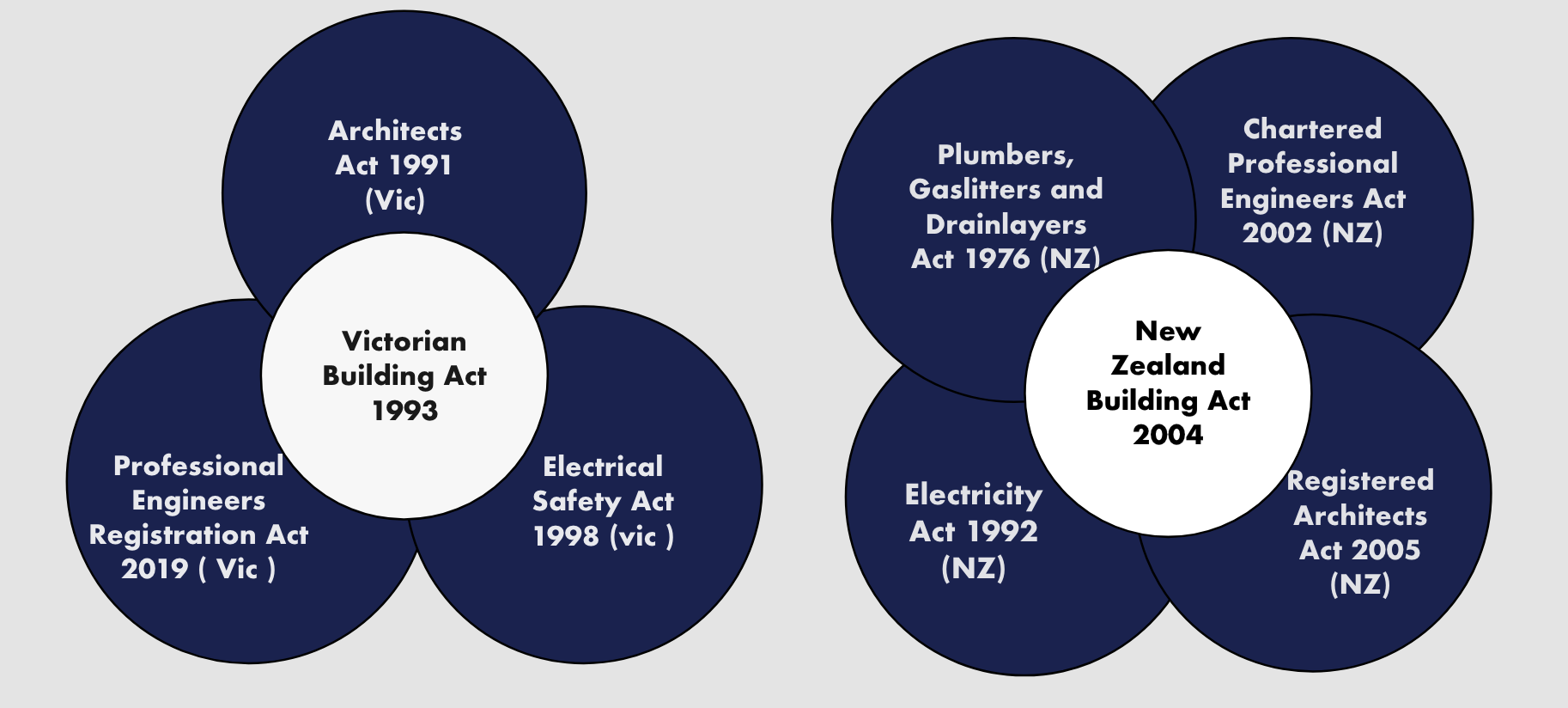

International Perspectives

Australian Precedent

Several Australian jurisdictions, including Victoria, have adopted proportionate liability along with compulsory insurance since 1993. This has led to significant benefits for local governments and has not shown signs of unsustainability.

Mandatory Insurance in Victoria

In Victoria, the following practitioners are required by law to carry professional indemnity cover:

- Engineers

- Building surveyors

- Building inspectors

- Draftspersons

- Architects

- Quantity surveyors

- Residential builders

Residential builders are required to carry home warranty cover, which protects the homeowner if the builder becomes insolvent or disappears.

The Road Ahead for New Zealand

Support from Local Government

The support for proportionate liability in Australia has been strong, with local governments backing the reforms.

Potential for Market Adaptation

Some argue that the insurance industry in New Zealand may be reluctant to underwrite mandatory cover. However, with the right regulatory changes, including mandatory registration of key practitioners and tightening up registration criteria, the market is likely to adapt.

Conclusion: A Call for Reform

To ensure fairness and sustainability in the construction sector, New Zealand should consider:

- Introducing proportionate liability

- Mandatory registration of key practitioners

- Compulsory insurance for all responsible actors

- Addressing the ten-year liability limitation period

Such reforms would alleviate the disproportionate burden on local councils and ensure a more equitable system for all parties involved.

Author biog:

Kim Lovegrove is admitted to practice in NZ, is a past president of the Northern Chapter of the NZIOB, a construction law reformer of many years, chair of the IBQC. He has been retained as a law reform advisor by the Japanese Government, some Australian governments and has had deployments with the World Bank in China and Southern Africa. He is also a member of the NZ Society of Construction Lawyers.

Related articles

Disclaimer

This article is not legal advice rather it is a discussion of the topic in only general terms.

Image Acknowledgements:

The digital renders used in this article were developed collaboratively by Lovegrove & Cotton and ChatGPT. The photo images that are not the digital renders are stock images sourced from Shutterstock.