Victorian Building Practitioners’ Insurance Requirements

The mandating of professional indemnity cover and public liability cover is one of the cornerstones and foundations of the Building Act 1993 (Vic) (‘the Act’) and a mandatory insurance regime has been in place for Victorian building practitioners since the early nineties.

The Building Practitioners’ Insurance Ministerial Order,[1] made pursuant to section 135 of the Act,[2] requires building practitioners as defined by the Act to be covered by either a professional indemnity insurance policy or a public liability insurance policy, depending on the categories and classes the building practitioner falls under. It is an offence to carry out work as a building practitioner without the required insurance or claim to be insured when uninsured.[3]

The VBA won’t register a building practitioner unless the practitioner carries the appropriate insurance cover.

This article discusses categories and classes of building practitioners required to be covered by insurance, the type and amount of insurance by which building practitioners are required to be covered and under what circumstances exclusion provisions in the policy for loss or damage arising from or concerning building work may be allowable.

Building Practitioner Categories and Classes

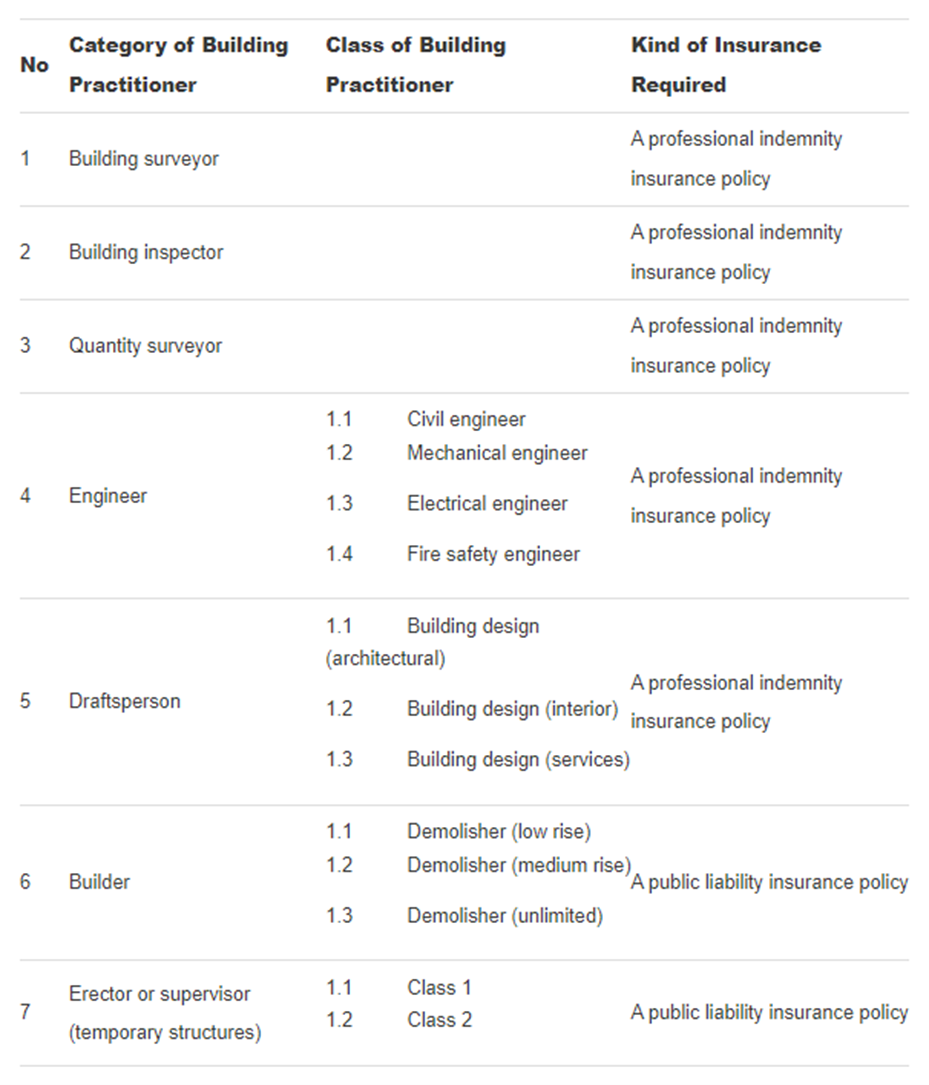

The categories and classes of building practitioners required to be covered by insurance are provided for in the Order as follows:[4]

Building practitioners required to have professional indemnity insurance cover

In Victoria building surveyors, building inspectors, quantity surveyors, engineers (civil, mechanical, electrical and fire safety engineers) and draftspersons (building design architectural, interior and services) must carry professional indemnity insurance cover. [4]

The cover must indemnify the building practitioner against any civil liability for any claim first made against the building practitioner during the period of insurance and notified to the insurer during such period which arises out of any breach of the professional duty of care of the building practitioner:

- in the conduct of the building practitioner as a building surveyor, building inspector, quantity surveyor, engineer or draftsperson (including any reasonably related professional activities); or

- in the conduct of the business of a building surveyor, building inspector, quantity surveyor, engineer or draftsperson (including any reasonably related professional activities) by a company or partnership of which the building practitioner is a director, principal, partner or employee.

Note: The Order states that the policy must extend to any claim arising from a contravention by the building practitioner of the Australian Consumer Law as per Schedule 2 of the Competition and Consumer Act 2010 (Cth)) and/or Part 2 of Australian Consumer Law and Fair-Trading Act 2012 (Vic) or the equivalent provisions of similar legislation in other States and/or Territories.

What is the amount of professional indemnity insurance required?

The Order states that the policy must specify a limit of indemnity of either: –

- The costs of the defence of claims (Defence Costs) are included in the limit of indemnity – not less than $1.5 million for any one claim, and in the aggregate for all claims during any one period of insurance; or

- Defence Costs are not included in the limit of indemnity:

- not less than $1 million for any one claim, and in the aggregate for all claims during any one period of insurance, not including Defence Costs; and

- not less than $500,000 for any one claim, and in the aggregate for all claims during any one period of insurance, in respect of Defence Costs.

Note: The policy must contain provision for at least one automatic reinstatement to the minimum level of cover specified above.

Is an exclusion clause allowed in the policy?

Unless an exception applies the policy must not exclude liability for loss or damage arising out of or concerning building work. Building work is defined in section 3 of the Act,[5]it means “work for or in connection with the construction, demolition or removal of a building.”

The policy may however contain a provision excluding liability for loss or damage arising from or concerning building work where the claim directly relates to or is connected with –

- An external wall cladding product that does not comply with the requirements of the Building Code of Australia, an Australian Standard or any other law of the Commonwealth, Victoria or any other State or Territory to the extent that it applies to cladding; or

- An external wall cladding product that is installed, used, or applied to a building in a manner that does not comply with the requirements of the Building Code of Australia, an Australian Standard or any other law of the Commonwealth, Victoria or any other State or Territory to the extent that it applies to cladding; or

- A high-risk external wall cladding product that is installed, used or applied to a building in a manner that does not comply with any declaration made under section 192B of the Act. [6]

“External wall cladding product” and “high-risk external wall cladding product” are defined in the Act as follows:[7]

- “External wall cladding product” means any product or material that is, or could be, used on or in the external wall of a building (including an attachment or ancillary element), but excluding any product or material that the regulations state is not an external wall cladding product;

- “High risk external wall cladding product” means an external wall cladding product that is the subject of a declaration prohibiting its use under section 192B of the Act;[8]

Building practitioners required to have public liability insurance cover

Builder demolishers (low rise, medium rise and unlimited) and erectors and supervisors of temporary structures (classes 1 and 2) are required to be covered by public liability insurance cover.

The policy of public liability insurance shall provide indemnity in respect of all sums which the building practitioner shall become legally liable to pay for compensation (excluding punitive or exemplary damages) in respect of personal injury or property damage caused by an occurrence in connection with the building practitioner’s business as a building practitioner or as a building practitioner of a company or partnership of which the building practitioner is a director, principal, partner or employee.

The policy may name as the insured either the building practitioner or the company/partnership of which the building practitioner is a director, principal, partner, or employee provided that where the insured is a company or partnership the policy shall provide indemnity to persons who are at the commencement of or who become during the period of insurance principals, partners, directors or employees of the company or partnership and are registered building practitioners in categories 6 and 7 above.

The policy shall not, save and except as provided in the Order (see below), exclude liability for loss or damage arising out of or concerning “building work” as defined in the Act,[9] unless such liability would otherwise have been excluded by the insurer’s standard wording for public liability insurance for the category of building practitioner at the time of the Ministerial Order,[10] provided that the policy pursuant to the Order shall not contain any terms which exclude cover by reason of claims in respect of personal injury or property damage having arisen directly or indirectly from or having been caused by or in connection with the erection, demolition, alteration of and/or addition to buildings or temporary structures by or on behalf of the insured, or any vibration, or any removal or weakening of support caused thereby.

The amount of public liability insurance required

The policy must specify a limit of indemnity for any one claim during any one period of insurance of not less than:

- $5 million for building practitioners in classes 6.1 and 6.2;

- $10 million for building practitioners in class 6.3;

- $5 million for building practitioners in classes 7.1 and 7.2.

The policy must also include, in addition to the limit of indemnity, provision for payment of the costs and expenses incurred by the insured with the consent of the insurer in defending or settling any claim and, in respect of any one claim, the policy may limit this sum to 20% of the limit of indemnity.

Caution

As stated at the outset of this article insurance for building practitioners has been mandatory since the early nineties. Having said that there have been numerous amendments to the Ministerial Orders. In the early nineties it was mandatory for building practitioners to carry a from of professional indemnity cover that made run off cover mandator. In the late nineties this requirement changed. It is very important that practitioners keep abreast of the orders as the insurance industry is a dynamic market and that which they insure can change from time to time. The above-mentioned cladding provisions are case on point.

For related articles on construction insurance requirements please see:

Domestic Building Insurance Requirements in Victoria

Disclaimer

This article is not legal advice and discusses it’s topic in only general terms. Should you be in need of legal advice, please contact a construction law firm. The experienced team at Lovegrove & Cotton can help property owners and building practitioners resolve any type of building dispute.

References:

[1] Victoria, Victoria Government Gazette, No S 19, 17 January 2020.

[2] Building Act 1993 (Vic) s 135.

[3] Ibid ss 136, 137.

[4] Ministerial Order (n 1).

[5] BA (n 2) s 3.

[6] Ibid s 192B.

[7] Ibid s 3.

[8] Ibid.

[9] Ibid.

[10] Ministerial Order (n 1).